As an employee, self-employed worker or retiree living in Portugal, you will have to pay income tax, called IRS. This is also true for other types of income, and like in other countries, Portuguese income tax is progressive and is directly withheld at source by the employer who then pays it to the State. In 2026, there are 9 tax brackets ranging from 12.5% to 48%, and they start from the first euro earned, with certain possible tax deductions. What are the tax brackets in Portugal? How do you calculate income tax? I am Lisbob, the expat assistant, and I tell you everything about income tax in Portugal in 2026.

Income Subject to IRS in Portugal

Income tax is called IRS in Portugal. This tax is levied on almost all income received by taxpayers. In total, six categories of income are subject to this tax:

Category A

This category includes income from employment, such as salaries, bonuses, commissions, participation payments, allowances, etc.

Category B

This category includes entrepreneurial and self-employment income. It covers income generated by carrying out any commercial, industrial, agricultural, forestry or livestock activity. Among other incomes, this category includes income from self-employment and all service activities, including those of a scientific, artistic or technical nature, whatever the nature.

Category E

This covers capital income, including interest on sight or term deposits, as well as dividends.

Category F

This category includes rental income such as income from rural, urban and mixed property. This category also covers income from the operation of tourist accommodation, as long as it is not linked to a business.

Category G

This includes increases in assets that are not taken into account in the other categories of income. These are for example: capital gains, compensation for indirect damages not proven and for loss of earnings, and compensation for moral damage. Amounts awarded because of non-compete obligations and unjustified increases in equity are also taken into account.

Category H

This is retirement income such as old-age pensions, disability pensions or alimony. It also includes benefits paid by insurance companies, pension funds or other entities, under complementary social security schemes or employer contributions that are not considered employment income.

It’s important to know the tax brackets in Portugal

Tax Schedule and Brackets in Portugal

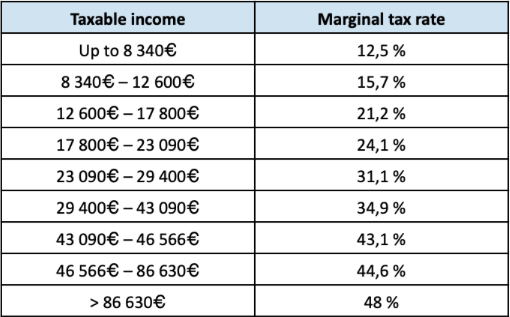

Portugal, like other countries, offers a progressive tax. This means that a rate is applied to each income bracket, not to the total.

For example, for an annual income of €16,000 you will be taxed at:

12.5% on €8,340

15.7% between €8,341 and €12,600

21.2% between €12,601 and €16,000

However, Portugal taxes income from the very first cent of euro earned, unlike France or United-Kingdom where there is a complete exemption below a certain threshold.

Also, Portugal has put in place withholding at source, which means that the amount of tax to be paid is directly deducted from wages by the employer. The employer then transfers the amounts collected to the Portuguese State.

Here is the income tax brackets in Portugal in 2026:

Tax brackets in Portugal in 2026

Tax Return

Even if taxes are withheld at the source, Portugal requires filing an annual tax return, which is done online on the Portal das Finanças. This return simply verifies the information and amounts received over the previous year.

This declaration is made from April to June for the previous tax year (from January to December in Portugal).

Thanks to this return, the Portuguese tax authorities can ensure that the correct amount has been collected. If necessary, two situations can occur: a refund from their part, or an adjustment of tax to be paid. It is also at this point that the tax authorities calculate the refund for invoices recorded in the previous year.

Deductions, Reductions and Tax Exemptions

Portugal allows specific deductions for each taxpayer category, as well as abatements taking into account personal conditions such as marital status, number of dependents, type of activity, etc.

It is possible to reduce donations to religious or charitable organizations from the amount of tax to be paid. It is also possible to deduct certain expenses from taxable income by recording these invoices throughout the year. Each taxpayer has part of the VAT they paid on certain categories of expenses reimbursed, and this refund can reach several hundred euros.

What Changes in 2026

Update of brackets: The income limits of each bracket are increased by about 3.5% to take inflation into account, which allows earning more before reaching the next bracket.

Slight reduction of rates: The rates for several intermediate brackets (notably 2nd to 5th) are reduced by about 0.3 percentage points each, in order to ease the tax burden on middle incomes.

Key Details to Remember

The IRS is progressive: the higher your income, the larger the portion subject to the higher rates.

Tax residents (those who live more than 183 days per year in Portugal) pay IRS on their worldwide income.

Non-residents pay tax only on income from Portugal.

Special regimes, like the Non-Habitual Residents (NHR), can also influence your tax situation depending on your status.