If you're thinking of moving to Portugal, obtaining a Tax Identification Number (NIF) is an essential step. Essential for a multitude of daily activities, from paying for groceries to buying a house, the NIF is your key to successful integration in this magnificent country. Contrary to popular belief, obtaining an NIF is quick and easy, even for non-EU/EFTA citizens, with the possibility of acquiring it online for less than €100 and in less than a week. In this comprehensive guide, I explain everything you need to know about obtaining your Portuguese NIF in 2025, online or in person, without hassle or excessive costs.

In this article:

What is a NIF?

The NIF, short for "Número de Identificação Fiscal", is a unique nine-digit personal identification number used in Portugal. Each resident is allocated a NIF, which remains valid indefinitely. Whether you need to open a bank account, sign an employment contract, or simply make purchases, the NIF will accompany you in almost all financial and administrative transactions in Portugal.

Why is the NIF essential?

The NIF is essential for anyone planning to live in Portugal. Here are some of the situations in which having a NIF is compulsory:

Applying for a Portuguese visa for non-EU/EFTA citizens;

Opening a Portuguese bank account;

Buying or renting a property in Portugal;

Subscribing to service contracts (internet, telephone);

Receiving an inheritance in Portugal;

And many other everyday circumstances.

As well as many other procedures. In short, the Portuguese NIF is simply essential for access to basic services such as accommodation. It's not for nothing that the NIF is cited as the first and most important step to take before moving to Portugal.

Obtaining a NIF will no longer hold any secrets for you

How do I obtain a NIF?

For citizens outside the EU/EFTA

If you are a citizen from outside the European Union, the European Economic Area or Switzerland, here's how you can obtain your Portuguese NIF:

Via an online company or law firm: This is the easiest and quickest way to obtain your NIF, especially if you are abroad. Several companies offer this online service, guaranteeing that you will obtain your NIF in less than a week at a cost of less than €100. Make sure you choose a reputable provider by checking online reviews.

In person: You can also obtain your NIF directly in Portugal by visiting a Finance office or Loja do Cidadão. Note that as a non-EU/EFTA resident, you will need a tax representative in Portugal, which may make this option more difficult if you do not already have contacts in the country.

For EU/EFTA citizen

If you are a citizen of an EU, EFTA or Swiss member state, you can obtain an NIF in the same way:

Via an online company or law firm: Once again, this is the quickest and easiest way to obtain your NIF from your current country. Several companies offer this online service, guaranteeing to obtain your NIF in less than a week at a cost of less than €100. Make sure you choose a reputable provider by checking online reviews.

In person: The most direct way to obtain a NIF is to go to a Finance office or Loja do Cidadão in Portugal. As an EU/EFTA citizen, you do not need a tax representative and the service is free. Bring your passport or national identity card and proof of address.

Documents required to obtain a NIF

To apply for a NIF, you will need :

Passport or National Identity Card: For all applicants, a valid identity document is required. Only EU citizens can apply for a NIF with an identity card.

Proof of Residence: An official document such as a utility bill, bank statement or driving licence, showing your current address.

If the application concerns a minor child, then the birth certificate will be required, and one of the parents will be the legal representative.

Obtaining a NIF in person

For those who choose to apply for their NIF in person in Portugal, here are a few tips:

Locate the nearest office: Use Google Maps to find a Finanças office or Loja do Cidadão near you.

Arrive early: Offices can be very busy, especially in big cities like Lisbon or Porto. Arriving early can help you avoid long waits.

Minor fees: For non-EU/EFTA residents, applying for an NIF may involve a minor administrative fee.

If you are already in Portugal then you will need to present the following documents:

Passport or identity card for EU citizens

Proof of address outside Portugal

Issuing the NIF is free and instantaneous when the request is made directly at a Portuguese tax office.

Be careful, however, as some offices do not accept people without an appointment made in advance, and queues are, as in all Portuguese public services, very long. What's more, no member of staff is required to speak any language other than Portuguese, so you may find it difficult to understand and make yourself understood. In the end, it is advisable to apply for your NIF online, before coming to Portugal. This saves time and money.

Obtaining a Portuguese NIF online easily

Your gateway to Portugal: Lisbob.net

Since 2017, my team and I have facilitated the journey of thousands of expats to their new life in Portugal, by simplifying the process of obtaining the precious NIF, the essential tax number. Our online platform, recognised for its efficiency and backed by countless positive testimonials on Google and Trustpilot, is your fast and secure solution.

Start your application in just a few clicks :

Go straight to the NIF application form and let our intuitive process guide you:

If you don't know us yet, you can check out the hundreds of positive reviews on Google and Trustpilot.

Confirmed identity: Enter your first and last name as they appear on your identity document.

Your plans for Portugal: What are your motivations? Work, retirement, investment? Your answer will help us to personalise our support.

Contact details and current address: Give your current address, including postcode, and make sure it matches the supporting documents you will be providing.

Documents required:

Identity: A clear copy of your passport or identity card (for European citizens), with a visible signature.

Proof of residence: A bank statement or bill less than 3 months old. Financial information may be blacked out for your confidentiality.

Select your deadline: Choose the processing time that suits you, depending on the urgency of your request.

Secure payment: Finalise your request by secure payment and receive instant confirmation.

Final step: You will receive a power of attorney to sign and return to us. In less than a week, you'll receive your NIF by email, ready to download and use as you need it.

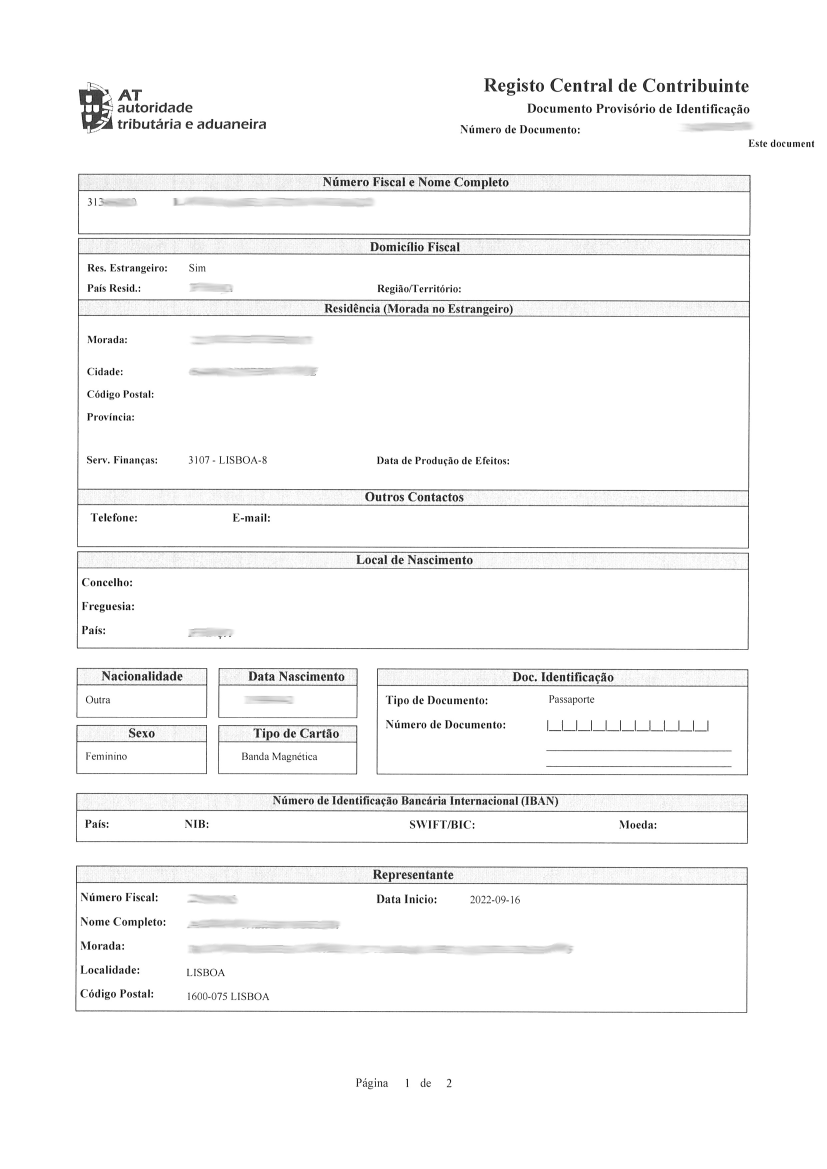

Here's what the NIF document looks like!

What happens after I get my NIF?

Your initial NIF will be linked to a non-Portuguese address. It is imperative, and legally required, to update this address as soon as you acquire permanent residence in Portugal. Lisbob can also facilitate this process for you, as well as access to the Finanças portal and other administrative services, such as tax declarations or registration for the RNH tax scheme.

With Lisbob, obtaining your Portuguese NIF online is more than just an administrative process; it's the start of a new adventure in Portugal, simplified and hassle-free.

4 reliable options for obtaining your Portuguese NIF online

In your quest to obtain a Portuguese NIF online, there are several options available to you. Here is a selection of 4 trusted sites that can make the process easier:

Each of these services offers unique advantages, from fast processing to personalised assistance. By comparing their offers, you can choose the one that best suits your needs and preferences. For those looking for a complete solution, our service on Lisbob.net is distinguished by our online and French-language support, giving you total peace of mind in your expatriation process.

I've prepared a full comparison of the prices, advantages and disadvantages of each site, available by clicking here.

Frequently asked questions

Here are a series of questions you're probably asking yourself about the NIF, along with their answers.

Do I need a Portuguese address to apply for a NIF?

No, you do not need a Portuguese address to apply. However, once you are a resident, you will need to update your address with the Portuguese tax authorities.

How much does it cost to obtain a Portuguese NIF?

The cost of applying for a Portuguese tax number in person at a Finanças office in Portugal is free. An online NIF application costs an average of €89. It should be noted that fiscal representation is compulsory to apply for a NIF remotely, and that this service is often limited in time and renewable.

How long does it take to obtain a NIF?

Online, the process can take less than 24 hours with the right services. In person, the NIF can often be issued the same day.

How long does it take to obtain a NIF?

The NIF can be obtained instantly from a Finanças office, and from 24 hours for an online application.

What is a contribuinte number?

This is another name for the NIF, the tax identification number. It can be translated as a taxpayer number.

How long is a NIF valid in Portugal?

A NIF number is permanent and valid for life. If you have already obtained one in the past, it is still active and you can use it again.

Can I open a Portuguese bank account without a NIF?

No, it is impossible to open a bank account in Portugal if you do not have a NIF.

Will I have a Portuguese NIF for tax purposes?

Obtaining a NIF in itself does not automatically make you a tax resident in Portugal. However, using a Portuguese address can signal to the tax authorities that you are a tax resident.

I am a European citizen. Do I need a tax representative?

If you apply for your NIF in person at a Finanças office, you do not. If you apply for your NIF remotely, then yes.

I'm Swiss, do I need a tax representative?

Yes,

Does the NIF help with visa and residence permit applications?

No. Although the NIF is compulsory in order to apply for a visa to live in Portugal, it has no influence whatsoever on the decision taken by the Portuguese immigration authorities.

Shopkeepers ask me for my NIF when I pay, is this normal?

Yes, it is compulsory for shop assistants to ask for the customer's NIF and to include it on the invoice.

Useful tips and warnings

Compare online services: If you choose to obtain a NIF online, take the time to compare services. Check the reviews and make sure they offer good value for money.

Plan ahead: Even if you haven't yet moved to Portugal, getting an NIF in advance can make a lot of things easier once you're here.

Documentation in order: Make sure that all your documents are valid and translated if necessary. A neat and complete presentation of your file will facilitate the process.

Beware of scams: Be wary of offers that seem too good to be true or that charge exorbitant fees to obtain an NIF.

Useful links

Lei Geral Tributária, aprovada pelo Decreto-Lei n.º 398/1998, de 17 de dezembro.

Lei n.º 7/2007, de 5 de fevereiro (cria o Cartão do Cidadao).