Since few years the IRS income tax declaration is entirely online in Portugal. The automatic IRS option is undoubtedly an option that greatly facilitates this obligation since it allows you to validate your declaration in a few clicks. If you want, you can trust fiscal authorities and let the declaration fill in automatically : you will just have to validate the declaration at the end of the process. Lisbob, the expatriate assistant in Portugal, tells you all about how to complete your automatic IRS tax return online, step by step. Because the sooner you validate and submit your return, the sooner you will receive a refund if you are entitled to it.

IRS tax declaration in Portugal : how to validate your declaration on the Finanças website

- Start by entering your personal space on the Finanças website. Authenticate with your taxpayer number and password. You can also use the cartão de cidadão (and the associated reader) or the mobile digital key to access this service.

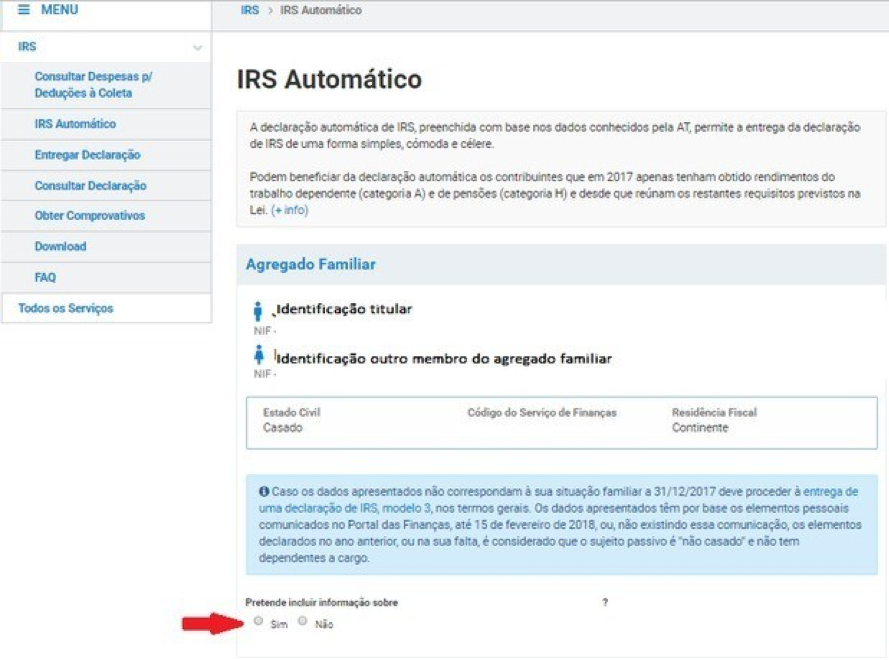

- Go to "IRS" >> "IRS automatico". A table will appear with the identification of the household in question.

- If the household includes more than one person, you must indicate at the end of the table if you wish to include data for another member of the household. You have to choose yes or no, and the button to continue appears. Then, the page to authenticate the remaining elements of the household appears.

- After the authentication of all the people of the tax household, a table showing the income, withholding taxes at source and expenses appears. It must be analyzed and you must confirm the information.

- And then the pre-liquidation: you can choose the option which is the most advantageous (in the example case there is no difference).

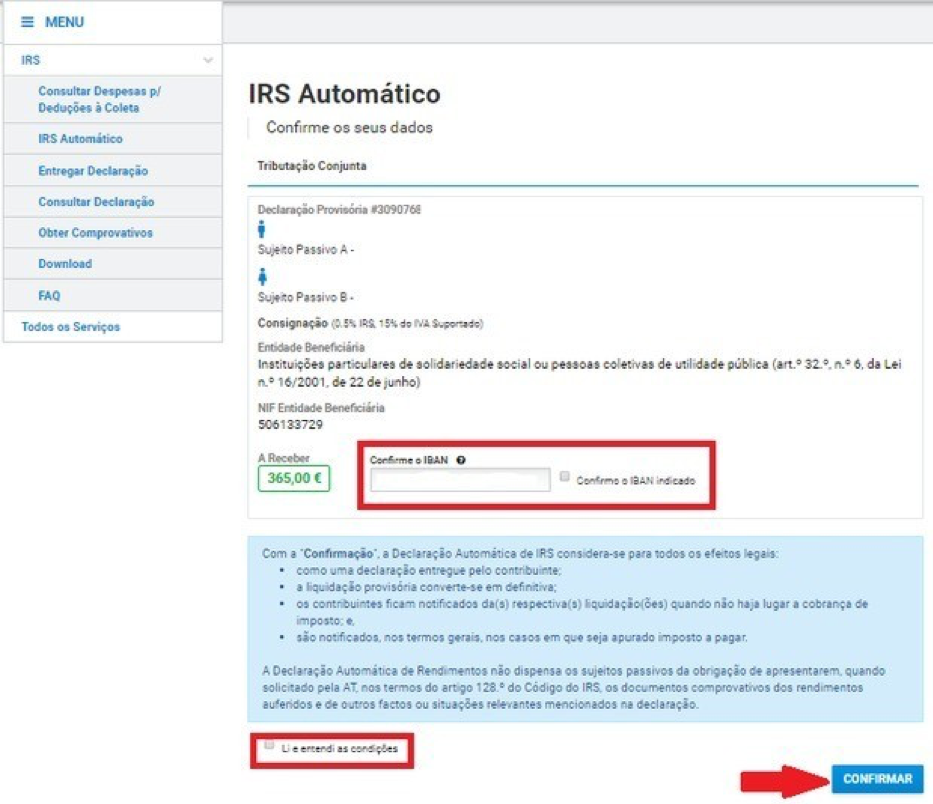

- You must check the option you wish to validate, and you can choose to donate 0.5% of your IRS and / or 15% of the VAT paid to a charity and solidarity institution of your choice. If this is the case then you will be asked for the NIF of the institution concerned.

- After clicking on "Accept" appears the final frame, where you must confirm the IBAN (your bank account), check the box "I have read and understood the conditions" and finally confirm.

- Your tax declaration has been submitted. On this final page you can obtain, by clicking on "comprovativo", your complete IRS declaration, which you can print or save in PDF format. You can also click on "print" and obtain proof of submission of the declaration. Please note that this is not proof that your declaration has been accepted but that it has been received. You will quickly receive a message confirming whether or not you have accepted your IRS declaration in Portugal.

And There you go ! Now you can wait for the tax refund. Filling your automatic IRS tax return in Portugal has never been easier thanks to Lisbob