You are an expatriate in Spain and you are looking for the house of your dreams, the one that will welcome all your lovely family? Or are you simply looking to invest in real estate in Spain and make a profit? The reasons for buying a house in Spain are many, and mistakes to avoid too. Indeed, many expatriates who rushed during the acquisition of their property in Spain and who unfortunately had to face many adventures, and sometimes significant financial losses. House seized after purchase, bad estimate of property taxes, we must be careful when buying a house or real estate in Spain. What are the pitfalls to avoid when acquiring a property ? What are the 5 mistakes to avoid ? Lisbob, the expatriate assistant in Spain, accompanies you on this wonderful adventure. Here are the 5 mistakes not to make when buying your house or real estate in Spain.

5 mistakes to avoid when buying a house or real estate in Spain

1. Forgetting to make the necessary checks

Have you found the perfect home in Spain? Don’t fall into the trap of not making the necessary verifications concerning the situation of the property in question from an urban and cadastral point of view. Indeed, we must always ensure that the property complies with all Spanish laws on building permits for example, especially in the purchase of property with swimming pool, well or hut. Attention, in Spain the main difference is that it is up to the buyer to make the steps to make the urban, cadastral and legal verifications concerning the property and the seller. It must also be verified that the property is authorized to receive the intended use. The notary in Spain has a much smaller role in the process of buying and selling real estate than he can have in other countries.

2. Not checking the existence of mortgages

Buying a house in Spain, it must not become a nightmare. To avoid unpleasant surprises, consider asking your notary to check if the current owner of the house you wish to acquire has no debt and no mortgage has been made on your future residence. This verification is essential, for the peace of mind that it will bring you and for the worries that it will avoid you! A rented home and it's your dream to live in Spain that flies away.

You can also go to a tax office to learn more about the possible mortgage of your property in Spain, but it will generate long hours of waiting. In the end, the notarial solution seems the most appropriate.

Be careful when you decide to move to Spain : a good preparation is the key to a successful project

3. Forgetting calculating taxes in advance

When you buy a house in Spain, you must pay, in addition to the price of your property, not only notary fees and various administrative procedures, but you must also pay taxes on the purchase of real estate. The payment of these taxes is mandatory, and you risk large fines if you do not pay. It is strongly advised not to underestimate the impact of these taxes when buying your property as this may impact your budget.

You will therefore have to pay the following Italian property taxes:

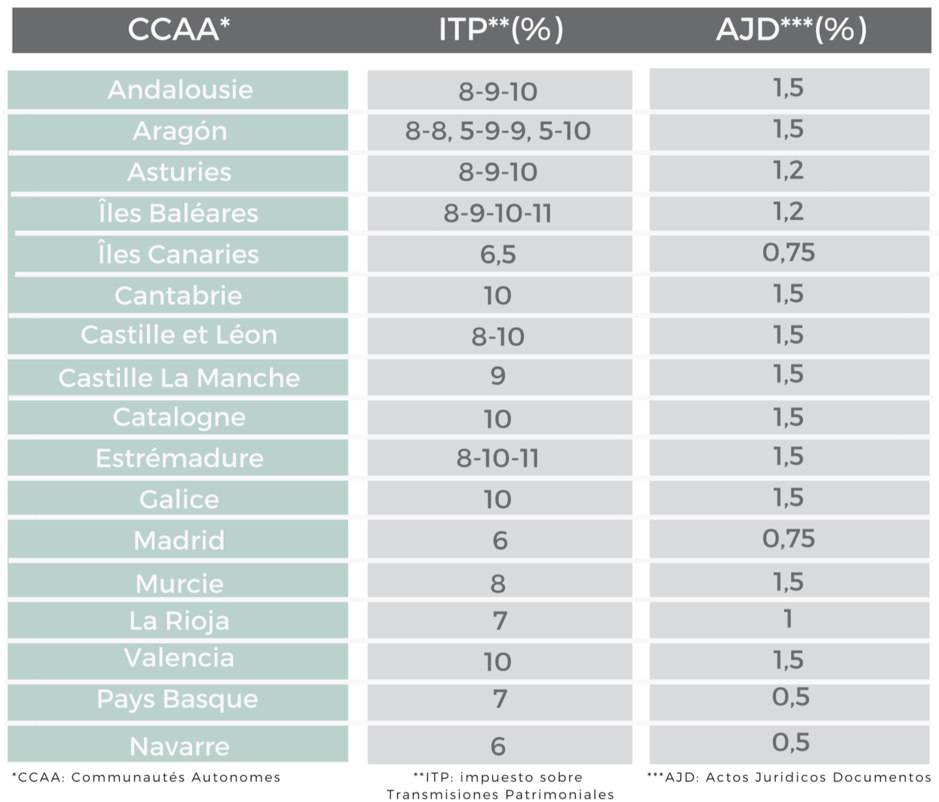

- Tax on the Documented Legal Acts, AJD (between 0.5 and 1.5%);

- Plusvalia Municipal (between 6 and 11%);

- VAT if the property is new (10% or 4% for social housing).

Each of these taxes has its own method of calculation, with different coefficients according to the regions of Spain. Not paying attention to these taxes when researching is already a serious mistake since the amounts can be a good percentage of the amount of real estate.

Here is a table summarizing the amount of different property taxes when acquiring property in Spain:

4. Avoiding negotiating your loan

There are two ways to choose when buying a home in Spain. On the one hand you can buy a fixed rate loan, and on the other, a variable rate loan. Each has its advantages and disadvantages. The variable rate loan is cheaper than the fixed rate loan but presents more risk. With this type of loan, your bank indexes your interest rate on the European EURIBOR index (one of the main money market reference rates in the euro zone). Which means that she can decide to lower your interest rate when everything is fine, but she can also decide to increase it if she does not! This was one of the reasons for the subprime crisis in the United States, and it is a gamble that, over the long term, can be risky. If you're not a gambler, the fixed-rate mortgage will cost you a little more, but you'll know in advance how much you'll have to pay back at the end of your loan. It is normal in Spain to see fixed-rate loan periods for only a limited period (2, 4, 6, 10, 15 years), the rest of the period being again at variable rates.

What is certain is that you should not buy a house in Spain without first negotiating your mortgage. This purchase is consequent, and you can make real savings by putting the banks in competition to pull the price of your loan down as much as possible.

Don’t be afraid to negotiate your loan with the bank

5. Believing that you can do it all alone

Buying a house in Spain, you've dreamed about it, it's an extremely important step in your expatriation. So do not take the risk to go wrong in your steps. Lisbob is there to accompany you throughout your installation in your new country of adoption. Practical advice, opening of gas and electricity contracts, and all the administrative procedures. Lisbob and his team take care of everything, so don’t hesitate to contact them to make your dream of expatriation in Spain a reality.